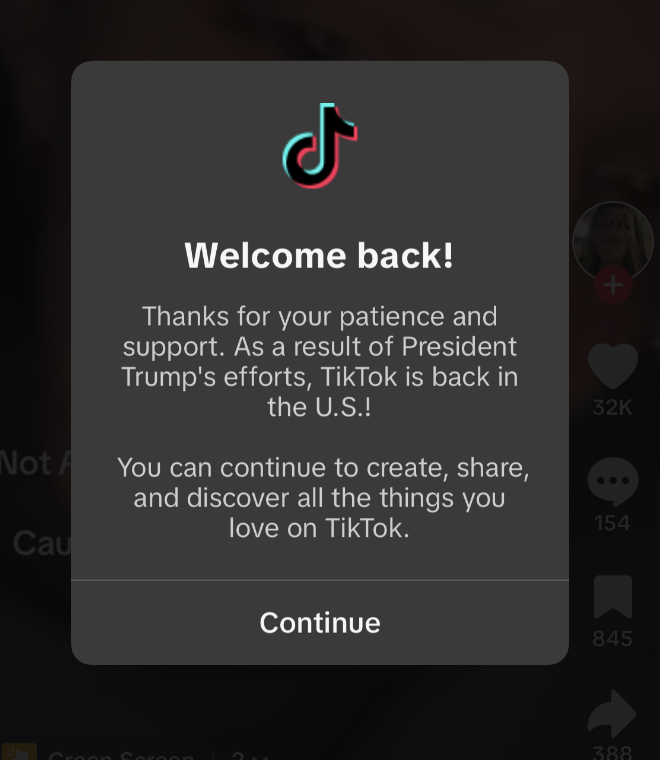

Many things have been looking up lately except for one thing: the economy unless we’re talking about the price of groceries. President Trump has many plans to build the American economy, such as an end to tax on tips, which can affect the income of many employees who often receive low pay and rely on tips to make it to the end of the week. His other plans include eliminating federal taxes on Social Security benefits and overtime pay, capping credit card interest rates by around 10% temporarily, lowering gas and grocery prices. He has already increased tariffs, believing they will create more jobs and expand American manufacturing. However, others say he promised these changes only as a tactic to win the election.

“I think that the president is using [tariffs] as a tactic to make sure that we’re getting paid what we should be getting paid,” Amy Robinson, a Dual Credit (DC) Economics teacher, said.

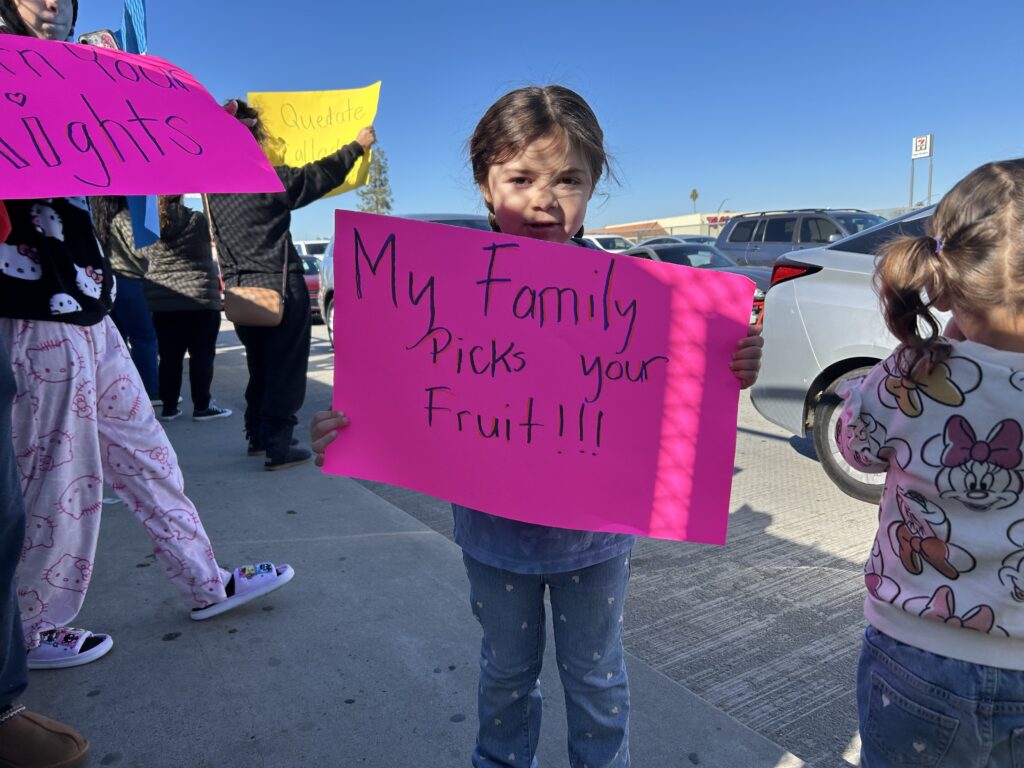

Tariffs have been mentioned a great deal in the news recently. Tariffs are taxes on imported or exported goods, and according to the official White House website, tariffs on Mexico, Canada and China have increased due to the threat of illegal aliens and substances. President Trump took this action intending to stop illegal immigration and reduce the importation of poisonous fentanyl and other drugs. Some people do not support these tariffs as changes like higher product pricescan harm domestic industries that rely on imported goods and can also affect global trade relationships. Others do support the tariffs because they can help stabilize the market and protect domestic industries and government revenue .

“I feel like we’re wasting money,” Robinson said. “Just wasting it, not on any particular country, just wasting it. It’s a lot of money. It’s just been thrown, and it’s been happening for years and years and years.”

The job market has seen a couple of changes. According to usbanks.com, the unemployment rate has declined to 4%, the lowest since May 2024, and job growth has slowed down. Payroll employment increased by 143,000 in January, and the initial weekly jobless claims ranged between 200,000 and 225,000. Many jobs were lost during the Covid-19 pandemic, but many of those jobs have returned to the industry.

“A lot more job opportunities since last year have come back because of Covid,” Robinson said. “Covid affected a lot of jobs that people could have.”

In January 2025, the inflation rate in the United States was 3%. Consumer Price Index (CPI) increased, after dropping to 2.4% for 12 months ending in September 2024 usbank.com. Consistent increasing inflation can be difficult to keep up with, and it can cause people to reduce their shopping habits.

“Money has to flow for the economy to be healthy,” Robinson said.

A battle many Republicans and Democrats can both agree on is the removal of pennies. Most people keep pennies in their piggy banks or the bottom of their wallets, not knowing that their production cost is nearly 4 cents. As a result, President Trump would like to remove the penny. President Trump has ordered the U.S. Mint to end the making of the penny. Last year, the U.S. Mint lost $85 million when creating pennies, according to the Bureau of Engraving and Printing annual report. Removing pennies can affect prices such as when rounding up or down prices, and it can have an impact on the cost of goods.

“Some of the other coins cost more [to make],” Robinson said. “It’s crazy to spend more [on the making of change].”