What to expect when you accept

College season: seniors are consumed with applications and juniors are in testing mode. Adults are pestering sophomores and freshmen are figuring their future education plans.

College is exciting but daunting. The ever increasing cost causes anxiety for families. But why is college so expensive?

The bulk of the expenses come from the tuition, which is the amount of money charged for instruction. Tuitions vary depending on what a college charges by the units of an academic year, such as a semester or quarter.

In addition to tuition, room and board is a major part of college cost of attendance.“Room and board is very important especially if you are living on campus,” Lymonte Thomas, University of Tennessee at Martin student and White Station class of 2015 graduate, said.

Room and board costs cover a student’s dorm and the food he or she will eat. Most colleges require freshmen to purchase a meal plan.

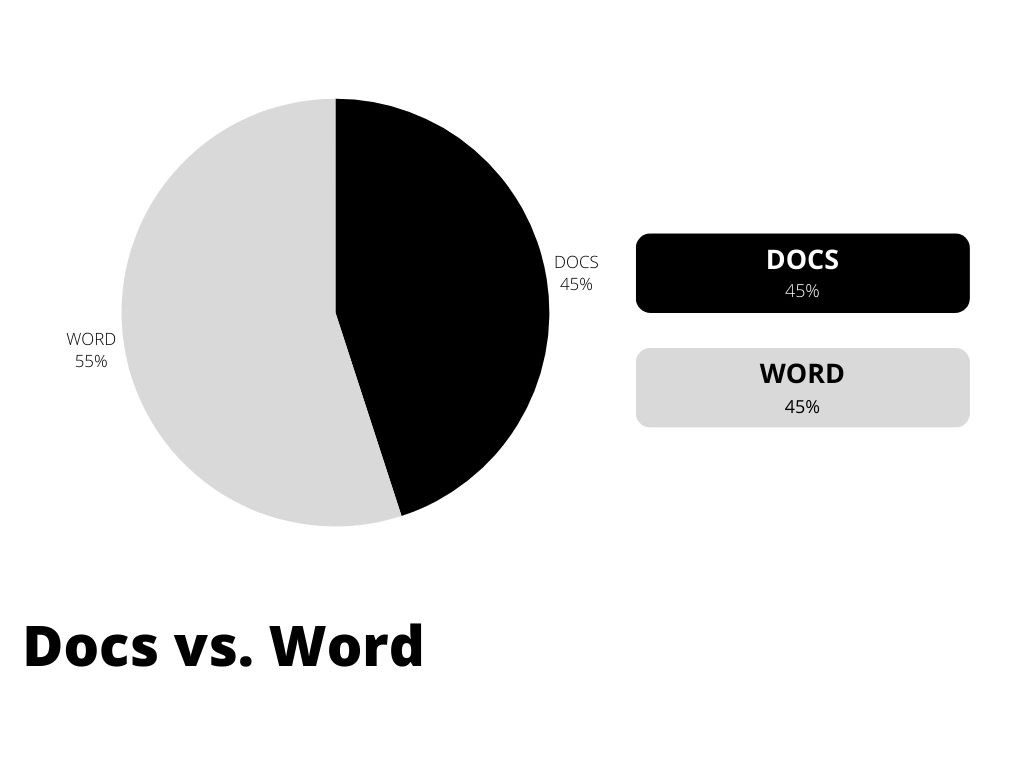

However, students eat off campus as well. In 2011, CNN reported the average college student spent $765 eating off campus. Of those students, 51 percent order takeout, 20 percent eat at restaurants, another 20 percent eat in the dining halls and nine percent grocery shop.

This is where budgeting comes into play.

“I do have a budget, but to be honest, I am always under it,” Akin Bruce, Rice University student and White Station class of 2015 graduate, said. “If you don’t want to spend money, you do not have to spend money. Sometimes people will get really picky about the cafeteria food or choose to go pay for something off campus just to get off campus.”.

In addition to food expenses, a budget should be made for textbooks, groceries, personal items, transportation or car expenses, entertainment and activities or emergencies.

According to the College Board, during the 2014-2015 school year, the average costs of books and supplies for a public college was $1,146, and the average costs of books and supplies for a private college was $1,244.

A survey conducted by usnews.com, in 2014, shows that 65 percent of students decided against buying textbooks for a required class due to the high costs. As an alternative, many students purchase their books from online retailers such as Amazon and eBay or rent their textbooks to save money.

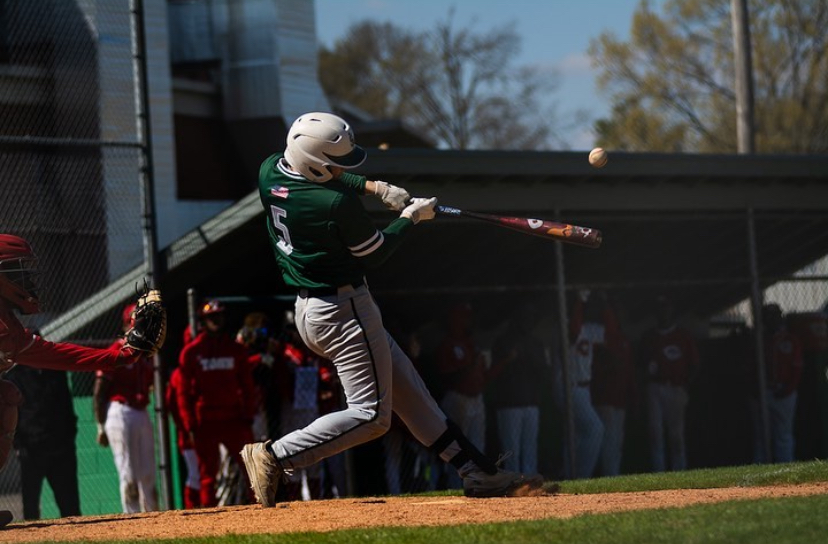

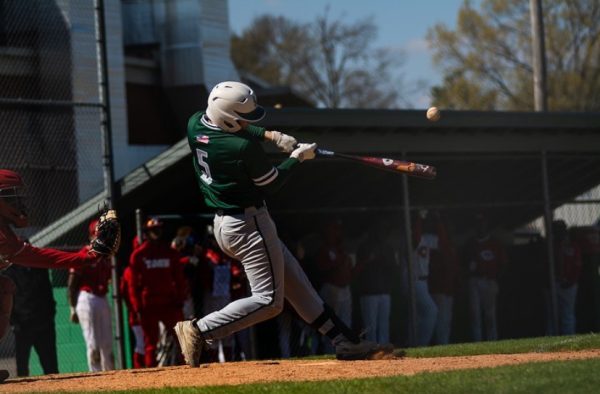

In the entertainment category, the majority of students spend zero to 25 dollars a week, according to CNN in 2011. Though how much a student spends depends on what the college has to offer, for example campus events could include movie showings, art exhibitions, on-campus plays and musicals, or sporting events.

“If a school has a “free” game room or a “free” gym, take advantage of it. Also if a school [has] a health facility free to student[s], [it] is an added plus,” Thomas, said.

Concerts and festivals provided by colleges, such as Springfest at University of California, Spring Fling at Yale University and Round Up Weekend at University of Texas at Austin are alternatives to expensive entertainment; some colleges even pay for local activities.

“We can get into the zoo for free. We also get things like Houston Symphony tickets and free admission to all home sporting events, unlike in high school,” Bruce said.

The price of college is overwhelming, but resources are available to adjust a student’s cost of attendance. The net price calculator shows the amount of money a student would be expected to pay to attend a specific college based off of financial status and financial aid. Along with scholarships that are merit-based, athletic, and any other talent or program a person could think of. So yes, college is expensive but there are tools to make the process easier.

Your donation will support the student journalists of White Station High School. Your contribution will allow us to purchase equipment and cover our annual website hosting costs.